Just like all investment returns, income from successful venture investments is taxable. Every year, a venture fund issues its investors Schedule K-1s to help them calculate their tax liabilities.

All venture investors should understand how to interpret and use a Schedule K-1, given they’ll likely receive a new one every tax season. In this guide, we’ll break down Schedule K-1s for both general partners and limited partners, including what they are, how they work, and how to read them.

Just like all investment returns, income from successful venture investments is taxable. Every year, a venture fund issues its investors Schedule K-1s to help them calculate their tax liabilities. All venture investors should understand how to interpret and use a Schedule K-1, given they’ll likely receive a new one every tax season. In this guide, we’ll break down Schedule K-1s for both general partners and limited partners, including what they are, how they work, and how to read them.

Key takeaways

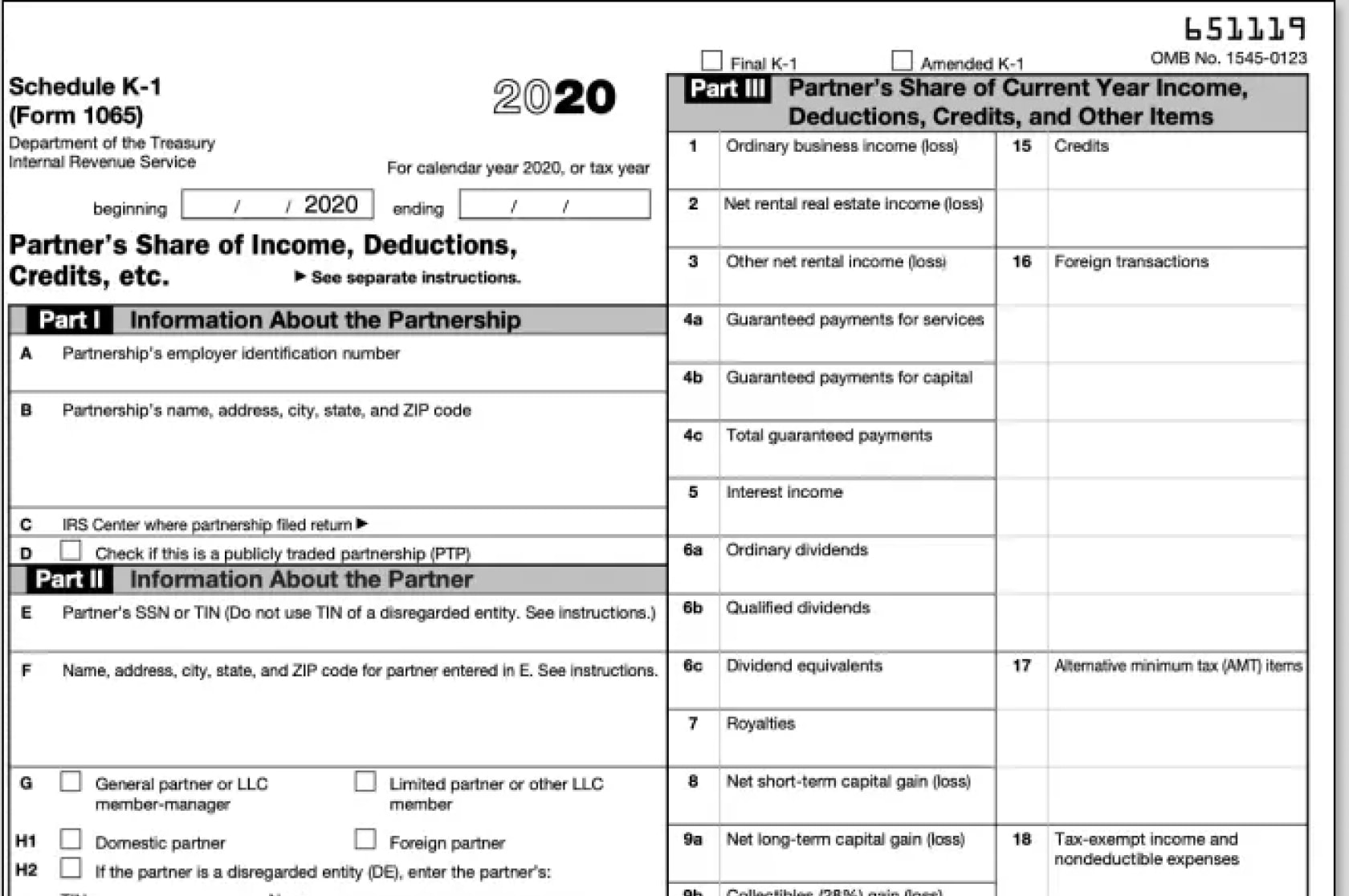

A Schedule K-1 is an IRS tax form that reports the gains, losses, interest, dividends, and other distributions of a business or financial entity’s partners from the previous tax year.

Because most venture funds are set up as limited liability partnerships—with a general partner (GP) running the fund and investors serving as limited partners (LPs)—all investors are considered partners of the fund. The investor receives a Schedule K-1 any year the fund records income or loss, both of which are considered taxable events.

The fund’s investors (both GPs and LPs) use the document to calculate their tax liability when they file taxes.

The partnership agreement an investor signs when investing in a venture fund dictates their share of assets, liabilities, and cumulative income/losses of the partnership—often referred to as the investor’s “capital account” in the partnership.

Deep dive

While both GPs and LPs are considered partners in the fund, the Schedule K-1 received by the fund manager and the limited partners in the fund will have a few marked differences. These differences reflect the different types of income a fund manager can earn from operating a venture fund.

For LPs in a venture fund, Schedule K-1 income is primarily investment income on lines 5, 6, and 11, as well as capital gains and losses on lines 8 and 9. GPs may see two additional income items on their Schedule K-1.

What is an insurance captive manager?

The fund management fee is an annual fee paid to the fund manager to cover fund operational costs and compensate the fund manager for their work. The partners in the fund cover the cost of the management fee, which usually ranges from 2% to 2.5% of committed capital.

A fund manager receiving management fees will see that income reflected on Line 4 (guaranteed payments) and Line 14 (Self-Employment Income) on their K-1.

What are the benefits of captive insurance?

Carried interest represents the percentage of profits paid to the fund manager in the event of distribution after an agreed-upon threshold of return has been reached for the fund’s partners.

For tax purposes, carried interest is considered a reallocation of partnership income from LPs to the carry recipient—meaning it retains the character (and line assignment) as the income received by the LPs. In most cases, it will appear on lines 8 and 9 (short-/long-term capital gains).

To qualify for the long-term capital gains tax rate, the fund manager must hold the assets generating the carried interest for a minimum of three years. LPs in a fund have a holding period of only one year to reach the long-term capital gains tax rate.

Short image caption goes here. Lorem ipsum dolor sit amet, consectetur adipiscing elit.

How does captive insurance protect you from volatility?

Carried interest represents the percentage of profits paid to the fund manager in the event of distribution after an agreed-upon threshold of return has been reached for the fund’s partners.

For tax purposes, carried interest is considered a reallocation of partnership income from LPs to the carry recipient—meaning it retains the character (and line assignment) as the income received by the LPs. In most cases, it will appear on lines 8 and 9 (short-/long-term capital gains).

How does captive insurance help businesses contain healthcare costs?

Carried interest represents the percentage of profits paid to the fund manager in the event of distribution after an agreed-upon threshold of return has been reached for the fund’s partners.

For tax purposes, carried interest is considered a reallocation of partnership income from LPs to the carry recipient—meaning it retains the character (and line assignment) as the income received by the LPs. In most cases, it will appear on lines 8 and 9 (short-/long-term capital gains).